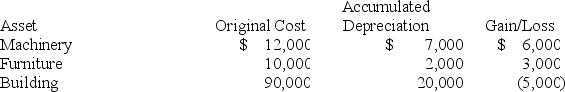

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Standard Costs

Standard costs are the estimated costs associated with the production of goods or services, used as target costs to aid in budgeting and performance evaluation.

Actual Costs

The real costs that a company incurs for producing or acquiring goods or services.

Direct Materials Price Variance

The difference between the actual cost of direct materials used in production and the standard cost of materials that were expected to be used.

Overhead

encompasses all ongoing business expenses not directly attributed to creating a product or service, including rent, utilities, and administrative costs.

Q5: Which of the following is not a

Q15: Manassas purchased a computer several years ago

Q16: The tax law places a fixed dollar

Q33: Goodwill and customer lists are examples of

Q41: Which of the following statements regarding home-related

Q50: Which of the following statements is True

Q53: Which of the following isn't reported on

Q70: Alfredo is self-employed and he uses a

Q90: Rayleen owns a condominium near Orlando, Florida.

Q104: Jocelyn, a single taxpayer, had $742,000 of