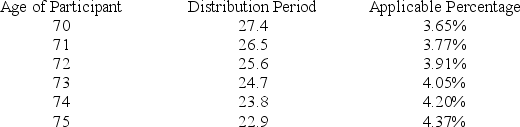

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,750,000. In 2018, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Definitions:

Church

A building used for public Christian worship or a Christian religious organization.

School

An institution designed for the teaching of students under the direction of teachers, typically involving a series of levels in the education system.

Social Rules

Norms and guidelines that dictate acceptable behavior and interactions within a society.

Cross-gender Contact

Interactions between individuals of different gender identities, often analyzed to understand socialization and gender dynamics.

Q5: Which of the items is not correct

Q13: Which of the following expenses are completely

Q16: Jasmine started a new business in the

Q27: Michael (single) purchased his home on July

Q35: Suvi, Inc. purchased two assets during the

Q36: Assets held for investment and personal use

Q47: Taxpayers who participate in an employer-sponsored retirement

Q51: Even a cash method taxpayer must consistently

Q88: Riley participates in his employer's 401(k) plan.

Q90: Taxpayers must maintain written contemporaneous records of