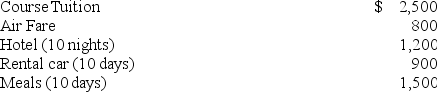

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

Definitions:

Emotionally Disturbed

Refers to individuals with significant emotional or behavioral disorders affecting their ability to learn.

Agitated

A state of nervousness or unrest, often characterized by increased movement or verbal activity.

Examination Room

A room specifically designed and equipped for healthcare providers to conduct medical examinations and consultations with patients.

Family Member

An individual belonging to a specific family, either by blood relations, marriage, or legal adoption.

Q16: Over what time period do corporations amortize

Q22: In order to deduct a portion of

Q31: Amelia is looking to refinance her home

Q39: Which of the following is not True

Q50: For estimated tax purposes, a "large" corporation

Q75: Tax-exempt interest from municipal bonds is an

Q76: Shantel owned and lived in a home

Q83: Rick recently received 500 shares of restricted

Q91: Scott and his wife Leanne (ages 39

Q99: Bozeman sold equipment that it uses in