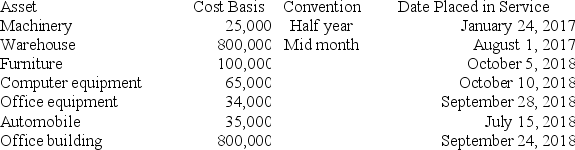

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Definitions:

Statistically Significant

A term indicating that a result from data analysis demonstrates a true effect or difference, beyond what would be expected by chance alone.

Inferential Statistics

A branch of statistics that allows us to make predictions or inferences about a population based on a sample of data.

Significance

The quality of being worthy of attention; importance.

Observed Difference

An observed difference refers to a noticeable disparity or variation between two or more entities, conditions, or data points, as discerned through observation or analysis.

Q28: Which of the following statements regarding employer

Q30: Which of the following statements regarding book-tax

Q30: Alexandra sold equipment that she uses in

Q40: Mercury is self-employed and she uses a

Q43: Harvey rents his second home. During the

Q46: Carmello and Leslie (ages 34 and 35,

Q72: In general, which of the following statements

Q78: Lenter LLC placed in service on April

Q81: In 2018, LuxAir Inc. (LA) has book

Q81: Kathy is 60 years of age and