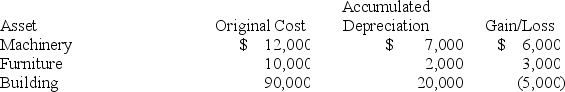

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Academic Challenges

refer to obstacles and difficulties encountered in the educational process that impact a student's ability to learn and achieve academic success.

School Absenteeism

The habitual non-attendance of a student at school without valid justification.

Poverty Level

A federally defined income threshold below which an individual or family is considered to be living in poverty, influenced by factors like household size and composition.

Homeless

Lacking a permanent place of residence.

Q23: Which of the following statements regarding excess

Q27: Grand River Corporation reported taxable income of

Q42: Tax considerations are always the primary reason

Q53: Collins Corporation, of Camden, Maine, wants to

Q54: Which of the following statements regarding Roth

Q66: Tristan transfers property with a tax basis

Q74: Which of the following would be considered

Q77: Which of the following is not usually

Q78: Lenter LLC placed in service on April

Q79: Roberto and Reagan are both 25 percent