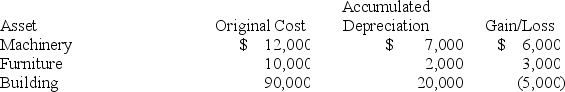

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Direct Method

A costing method primarily used in cost accounting that allocates service department costs directly to production departments without any intermediate allocations.

Prepaid Expense

Payments made for goods or services to be received in the future, considered as an asset on the balance sheet until used or consumed.

Accrued Liabilities

Obligations that a company has incurred, for which it has not yet paid cash or issued payment during the accounting period.

Direct Method

An approach in cost accounting used to allocate service department costs directly to producing departments without distributing service costs between service departments.

Q8: Which of the following statements regarding personal

Q17: Viking Corporation is owned equally by Sven

Q17: Tax rules require that entities be classified

Q22: The excess loss limitations apply to owners

Q24: Which of the following statements does not

Q37: A tax loss from a rental home

Q60: Judy is a self-employed musician who performs

Q69: Robert is seeking additional capital to expand

Q76: Sole proprietorships must use the same tax

Q91: Redoubt LLC exchanged an office building used