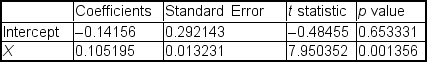

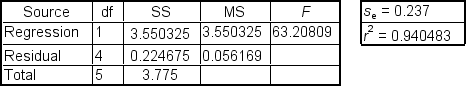

Alan Nip, market analyst for Clear Sound Mart, is analyzing the relation between heavy metal CD sales and the size of the teenage population.He gathers data from six sales districts.Alan's dependent variable is annual heavy metal CD sales (in $1,000,000's) , and his independent variable is teenage population (in 1,000's) .Regression analysis of the data yielded the following tables:

Alan's regression model can be written as: ___.

Alan's regression model can be written as: ___.

Definitions:

Stock Dividend

A dividend payment made by a company to its shareholders in the form of additional shares, rather than cash.

Taxable

Subject to taxation by governmental authorities.

Economic Benefit

The advantage or gain received from resources or actions, typically measured in terms of monetary value.

Exempt

Income, property, or persons not subject to taxation under certain conditions or qualifications.

Q22: The exponential distribution is especially useful in

Q27: Suppose the alternative hypothesis in a hypothesis

Q27: In a multiple regression analysis with N

Q32: Suppose x is a normal random

Q34: A multiple regression analysis produced the following

Q55: Alice Zhong is the VP of Operations

Q59: Elwin Osbourne, CIO at GFS, Inc., suspects

Q67: On Saturdays, cars arrive at David Zebda's

Q73: When a range of values is used

Q102: If x, the time (in minutes)to