Essay

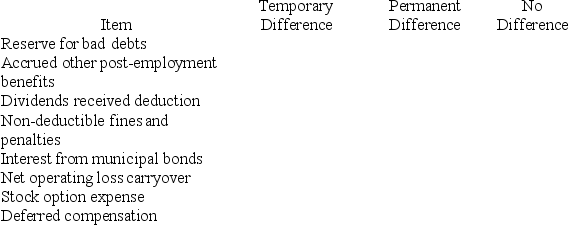

Identify the following items as creating a temporary difference, permanent difference, or no difference.

Definitions:

Related Questions

Q8: Katrina is a one-third partner in the

Q12: Scott is a 50% partner in the

Q20: Amy transfers property with a tax basis

Q26: ASC 740 permits a corporation to net

Q33: Which of the following statements does not

Q34: Irish Corporation reported pretax book income of

Q45: Which of the following statements best describes

Q82: Which of the following statements is True

Q88: This year, HPLC, LLC was formed by

Q96: Cavalier Corporation had current and accumulated E&P