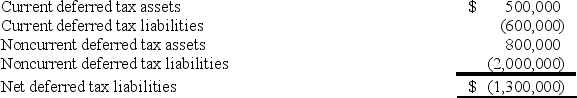

In 2018, Moody Corporation recorded the following deferred tax assets and liabilities:

All of the deferred tax accounts relate to temporary differences that result from the company's U.S. operations. Moody wants to minimize the number of deferred tax accounts it reports on the balance sheet. What is the minimum number of deferred tax accounts Moody reports on its balance sheet and what are the names and dollar amounts in each account?

Definitions:

Paying Attention

The process of focusing cognitive resources on a specific aspect of the environment while ignoring other perceivable information.

Organised

Having one's thoughts, actions, and possessions in order so as to operate efficiently and effectively.

Wernicke's Area

A region of the brain important for language development, located in the temporal lobe, responsible for the comprehension of speech.

Pituitary Gland

A small, pea-sized gland located at the base of the brain, considered the master gland because it produces hormones that regulate many functions of other endocrine glands.

Q12: Robinson Company had a net deferred tax

Q42: Residential real property is not like-kind with

Q47: Once determined, an unrecognized tax benefit under

Q53: Which of the following assets would not

Q65: Buzz Corporation sold an office building that

Q72: The main difference between a partner's tax

Q77: Swordfish Corporation reported pretax book income of

Q77: If the partnership has hot assets at

Q82: Unrecaptured §1250 gains apply only to individuals.

Q93: Tyson is a 25% partner in the