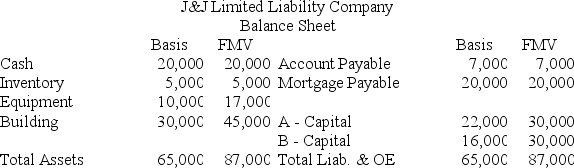

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Discrimination

Unjust or prejudicial treatment of different categories of people, especially based on race, age, sex, or disability.

Special Privileges

Unique rights or advantages granted to specific individuals or groups, not available to everyone.

Noncitizens

Individuals who do not hold citizenship status in the country in which they reside.

Temporary Work

Employment that is limited in duration, often to fulfill short-term needs of the hiring organization.

Q6: In 2018, AutoUSA Inc. received $4,600,000 of

Q14: In general, an S corporation shareholder makes

Q25: When determining a partner's gain on sale

Q35: The United States generally taxes U.S. sourced

Q35: Clampett, Inc. has been an S corporation

Q58: What is the unextended due date of

Q61: Tennis Pro, a Virginia Corporation domiciled in

Q66: Which of the following is incorrect regarding

Q94: Biggain Corporation distributes land with a fair

Q113: Giving samples and promotional materials without charge