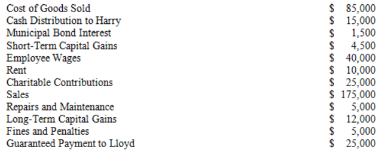

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Definitions:

Ethical Misconduct

Inappropriate actions or decisions in a professional or organizational context that go against established ethical guidelines or principles.

Lying to Employees

The unethical practice of providing false or misleading information to employees by their employers or managers.

Breaching Employee Privacy

Breaching employee privacy involves violating the confidentiality and personal space of employees without consent, often concerning personal information or activities within the workplace.

Abusive Behaviour

Actions that intentionally harm or create a risk of harm, physically or emotionally, towards others.

Q8: Siblings are considered "family" under the stock

Q10: Comet Company is owned equally by Pat

Q16: Commercial domicile is the location where a

Q28: Jenny has a $54,000 basis in her

Q47: One of the tax advantages to an individual

Q54: Continuity of interest as it relates to

Q62: Which of the following foreign taxes is

Q84: Aztec Company reports current E&P of $200,000

Q85: Kristen and Harrison are equal partners in

Q97: Kedzie Company determined that the book basis