Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

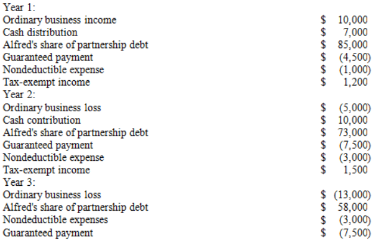

Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Definitions:

Maximin Criterion

The claim that the government should aim to maximize the well-being of the worst-off person in society.

Equal Income

A hypothetical or policy-driven scenario where all individuals or households receive the same amount of income.

Transitory Income

Income that is temporary or not consistent, such as bonuses, gifts, or any other earnings that are not regular or guaranteed.

Absolute Level

A specific, fixed point or quantity that is not relative or compared to any other point or quantity.

Q7: A state's apportionment formula usually is applied

Q26: The "double taxation" of corporate income refers

Q33: Knollcrest Corporation has a cumulative book loss

Q35: If a taxpayer sells a passive activity

Q41: S corporations are not entitled to a

Q44: Which of the following activities will create

Q54: For incentive stock options, the value of

Q66: Reno Corporation, a U.S. corporation, reported total

Q69: Which person would generally be treated as

Q79: At the beginning of the year, Clampett,