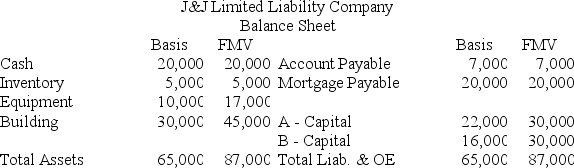

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Hasty Generalizations

Logical fallacies that occur when a conclusion is made about a whole group based on insufficient evidence from a few examples.

Fallacies

Erroneous argumentative patterns or misleading reasoning that undermine the logic of an argument.

False

A term indicating that a statement or proposition does not align with reality or is incorrect.

Insufficient Basis

A flaw in reasoning or argumentation where the evidence or grounds provided are not adequate to support the conclusion drawn.

Q14: Which of the following requirements do not

Q19: A corporation's "earnings and profits" account is

Q36: Mighty Manny, Incorporated manufactures ice scrapers and

Q48: El Toro Corporation declared a common stock

Q57: An exemption equivalent is the amount of

Q85: Assume that at the end of 2018,

Q86: Which of the following isn't a typical

Q92: If an S corporation shareholder sells her

Q96: Daniela is a 25% partner in the

Q130: ABC Corp. elected to be taxed as