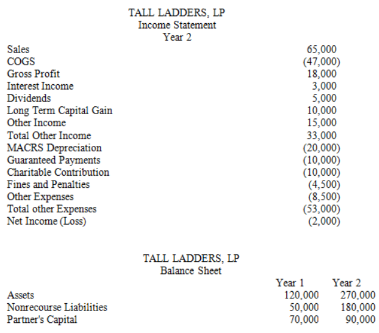

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Routines

Predefined sequences of code that perform a specific task and can be executed by a program.

Scope

In programming, the context or range in which a variable or function is accessible or valid.

Tag

"A text-based name for an area of the controller’s memory where data are stored."

Application

Software designed for a specific task or purpose, often used on computers, smartphones, or other electronic devices.

Q6: In 2018, AutoUSA Inc. received $4,600,000 of

Q16: Only taxable income and deductible expenses are

Q16: Daniela is a 25% partner in the

Q43: Entities classify all deferred tax assets and

Q52: On January 1, 2017, GrowCo issued 50,000

Q55: Hector formed H Corporation as a C

Q59: In January 2018, Khors Company issued nonqualified

Q64: Which of the following foreign taxes are

Q70: A state's apportionment formula divides nonbusiness income

Q107: Schedule M-1 reconciles from book income to