Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

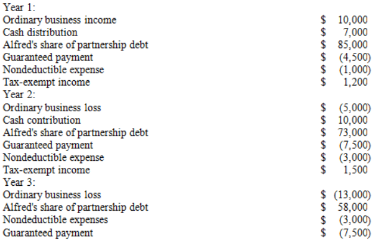

Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Definitions:

Predicting Wrongdoing

The process of using information or trends to forecast unethical or illegal activities.

Ethical Focus

The prioritization of moral values and principles in decision-making processes, often within a business or organizational context.

Privacy

The right of individuals to keep their personal information secure and free from unauthorized access.

Predictive Analytics

The use of data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data.

Q6: In 2018, AutoUSA Inc. received $4,600,000 of

Q29: Bingo Corporation incurred a $10 million net

Q38: Daniela is a 25% partner in the

Q48: Jamie transferred 100 percent of her stock

Q60: Maria, a resident of Mexico City, Mexico,

Q62: Which of the following foreign taxes is

Q76: Manchester Corporation, a U.S. corporation, incurred $100,000

Q78: State tax law is comprised solely of

Q108: Corporations are not allowed to deduct charitable

Q113: Giving samples and promotional materials without charge