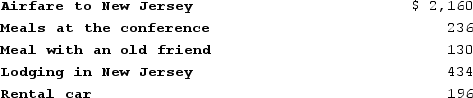

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelley documented her expenditures (described below) . What amount can Shelley deduct?

Definitions:

Trade Promotion

Marketing activities executed to increase product demand among wholesaler, retailer, or distributor levels.

Fixed Cost

Costs that do not change with the level of production or sales activities, such as rent, salaries, and insurance.

Managerial Levers

Tools or mechanisms that managers can use to influence the performance and direction of their organization, such as decision-making processes, organizational structure, and resource allocation.

Large Lots

Bulk quantities of goods, often purchased or produced to achieve economies of scale but can lead to increased storage costs and risks.

Q5: Which of the following is a true

Q6: Going to the opera or the ballet

Q10: Henry, a single taxpayer with a marginal

Q12: Name one effect of the Occupational Health

Q15: Which of the following statements accurately describes

Q23: A researcher is interested in acquiring a

Q45: Alain Mire files a single tax return

Q86: Maria and Tony are married. Assume their

Q86: Even a cash-method taxpayer must consistently use

Q93: Long-term capital gains are taxed at the