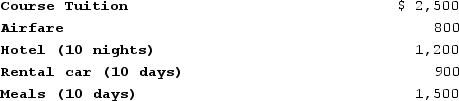

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year, Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

What amount of travel expenditures can Sam deduct?

Definitions:

Routing

The travel pattern used in working a sales territory.

Travel Pattern

The habitual movement or route taken by an individual or group, often analyzed for planning effective sales and marketing strategies.

Routing Reports

are documents or systems that track and manage the journey of tasks, products, or information through a prescribed sequence of actions or stages.

Key Accounts

Accounts the loss of which would greatly affect sales and profits.

Q8: Interest earned on a city of Denver

Q8: Which of the following levels of care

Q8: Which Canada Health Act principle does the

Q9: To be deductible, business expenses must be

Q14: What has been a significant contributing factor

Q16: Which is a characteristic of class conflict?<br>A)conflict

Q51: When the wash sale rules apply, the

Q79: Discuss why it is important to not

Q122: If there is not enough gross tax

Q129: Identify the rule dictating that on sale