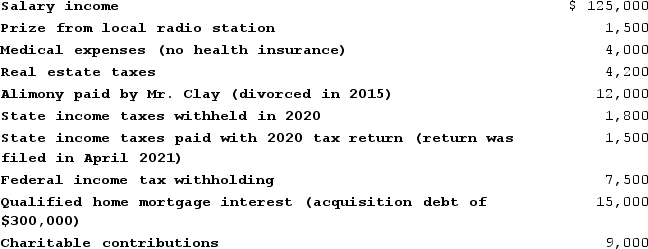

During all of 2020, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2020. Neither is blind, and both are under age 65. They reported the following tax-related information for the year. (Use the tax rate schedules, 2020 Alternative minimum tax (AMT)exemption)

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Supplies Costs

Expenses for materials and items necessary for the maintenance and operation of a business.

Flexible Budget

A budget that adjusts or varies with changes in volume or activity levels, used for planning and control.

Spending Variance

The difference between the actual amount of money spent and the budgeted amount for a specific period.

Revenue and Spending Variances

involves analyzing the differences between budgeted and actual figures for revenue and expenditures, helping businesses understand financial performance.

Q5: Over the past several decades, how has

Q6: Deductible medical expenses include payments to medical

Q12: Jaylin is a refugee living in Alberta

Q17: Which ethical principle requires health care providers

Q43: Brad operates a storage business on the

Q46: Qualified dividends are taxed at the same

Q110: Unemployment benefits are excluded from gross income.

Q118: Hal Gore won a $1.75 million prize

Q127: Graham has accepted an offer to do

Q132: Which of the following is not true