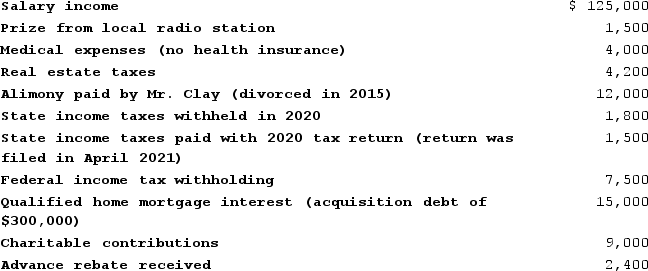

During all of 2020, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2020. Neither is blind, and both are under age 65. They reported the following tax-related information for the year. (Use the tax rate schedules, 2020 Alternative minimum tax (AMT)exemption)

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Operating Income

Income from a company's main business activities, excluding expenses such as interest and taxes.

Fixed Costs

Costs that do not vary with production volume, such as rent, salaries, and insurance premiums.

Sales Mix

Refers to the combination of different products or services that a company offers, influencing overall sales and profitability.

Unit Contribution Margin

The difference between the selling price per unit and the variable costs per unit, representing how much each unit sold contributes to covering fixed costs and generating profit.

Q20: Which population group would not benefit from

Q44: Jack and Jill are married. This year

Q49: Taxpayers filing single and taxpayers filing married

Q55: If an unmarried taxpayer iseligible to claim

Q69: Kaelyn's mother, Judy, looks after Kaelyn's four-year-old

Q78: Which of the following is a true

Q113: Regular taxable income is the starting point

Q123: Joanna received $60,000 compensation from her employer,

Q127: Jamie is single. In 2020, she reported

Q154: Parents may claim a child and dependent