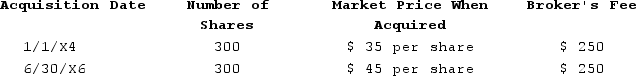

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Do not round intermediate calculations.)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Affirmative Action

Policies or procedures intended to address historical inequalities and discrimination by providing advantages in education, employment, and other areas to groups that have been marginalized.

Federal Government

The national government of a federal state, which holds the authority to govern matters that affect the entire country, distinct from state or local governments.

American Firms

Companies or businesses that are based in the United States, operating either domestically or internationally, and governed by American laws and economic policies.

Personal Responsibility and Work Opportunity Reconciliation Act

A 1996 US federal law aimed at reforming welfare programs, encouraging work, and reducing dependency on government assistance.

Q3: What are the two largest cost drivers

Q9: Don operates a taxi business, and this

Q9: In April of Year 1, Martin left

Q13: What major change in political thinking occurred

Q19: Todd operates a business using the cash

Q38: Smith operates a roof repair business. This

Q56: Nontax factor(s)investors should consider when choosing among

Q71: Which of the following is a true

Q100: Colbert operates a catering service on the

Q133: Ophra is a cash-basis taxpayer who is