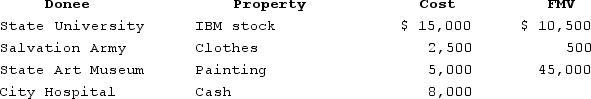

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Definitions:

Coercive

Relating to or using force or threats to persuade someone to do something against their will.

Less Explicit

Describing something that is not clearly or directly expressed, leaving room for interpretation or assumption.

Coercive Forms

Methods or strategies that rely on force or threats to compel individuals or entities to act in a particular way.

Daily Organizational Life

Refers to the everyday processes, activities, and experiences that occur within organizations.

Q8: Assuming a positive interest rate, the present

Q43: In June of Year 1, Eric's wife,

Q51: Which of the following audits is the

Q66: A taxpayer's at-risk amount in an activity

Q76: One limitation of the timing strategy is

Q79: In certain circumstances, a taxpayer who provides

Q87: Due to the alternative minimum tax rate

Q118: Hal Gore won a $1.75 million prize

Q142: Persephone has a regular tax liability of

Q150: Jake sold his car for $2,400 in