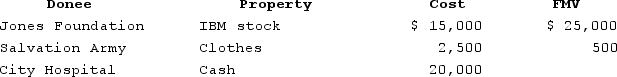

In 2020, Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Pessimistic Attributional Style

A tendency to habitually attribute negative events to stable, global, and internal causes, potentially leading to depressive symptoms.

Intellectual

Relating to the intellect; involving deep cognitive thinking skills, understanding, and reasoning.

Unrealistic Optimism

The belief that positive outcomes will happen, often ignoring the realistic likelihood of adverse events.

False Consensus Effect

A cognitive bias where people overestimate the extent to which their opinions, beliefs, preferences, values, and habits are normal and typical of those of others.

Q32: Which of the following taxes will not

Q55: Secondary authorities are official sources of the

Q61: This year Tiffanie files as a single

Q69: The deduction to individual taxpayers for charitable

Q69: A taxpayer paying his 10-year-old daughter $50,000

Q81: Assuming an after-tax rate of return of

Q98: If Paula requests an extension to file

Q117: In addition to the individual income tax,

Q144: Generally, 85 percent of Social Security benefits

Q147: The alternative minimum tax system requires taxpayers