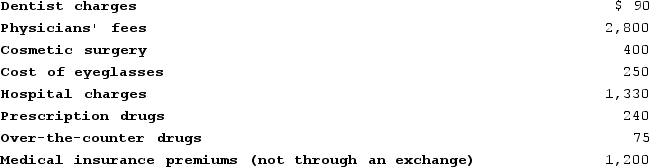

Jenna (age 50)files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Definitions:

Syndrome

A cluster of symptoms or conditions that occur together, indicating the presence of a particular disease or abnormality.

Symptoms

The physical or mental features that are regarded as indicating a condition or disease, often noticed by the individual affected.

Group

A collection of individuals who come together for a common purpose or share similar interests.

Retrovirus

A virus capable of reversing the normal genetic writing process, causing the host cell to replicate the virus instead of itself.

Q47: The Dashwoods have calculated their taxable income

Q47: The business purpose, step-transaction, and substance-over-form doctrines

Q51: Which of the following expenditures is most

Q63: The downside of tax avoidance includes the

Q73: Compare and contrast the constructive receipt doctrine

Q81: The standard deduction amount for married filing

Q91: If a taxpayer has little cash and

Q97: From AGI deductions are generally more valuable

Q126: The receipt of prizes and awards is

Q127: Graham has accepted an offer to do