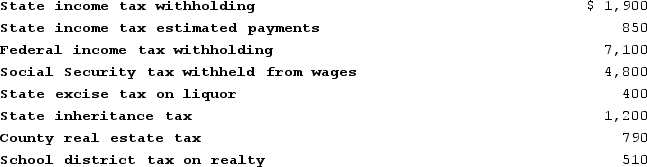

Chuck has AGI of $70,000 and has made the following payments:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Definitions:

Consumer Price Index

A calculation that evaluates the weighted mean prices of a group of consumer items and services, including healthcare, food, and transport, for assessing inflation.

Percent Per Year

A rate or proportion of a quantity expressed as a fraction of 100 per annum.

Inflation

The speed at which the average price of goods and services increases, resulting in a reduction of money's buying power.

Purchasing Power

The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy.

Q6: Wilma has a $45,000 certificate of deposit

Q35: If tax rates will be higher next

Q38: Bob Brain files a single tax return

Q42: Excess business losses are carried back and

Q62: Alvin is a self-employed sound technician who

Q68: In January of the current year, Dora

Q76: Karl works at Moe's grocery. This year

Q84: Investing in municipal bonds to avoid paying

Q122: If there is not enough gross tax

Q125: Tom Suzuki's tax liability for the year