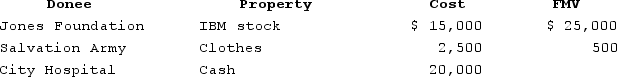

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Account Balances

The amounts of money present in or owed by an account at any given time.

Retained Earnings

The portion of net income that is not distributed to shareholders as dividends but is kept by the company for reinvestment in its core business or to pay debt.

Office Equipment

The fixtures, machinery, and devices used in an office environment to support business operations, including computers, printers, and copiers.

Dividends

Payments made by a corporation to its shareholder members, typically out of its profits.

Q7: This year Amanda paid $749 in federal

Q15: The IRS DIF system checks each tax

Q23: By the end of Year 1, Harold

Q23: Roy, a resident of Michigan, owns 25

Q32: The late payment penalty is based on

Q45: Which of the following statements concerning tax

Q49: On the sale of a passive activity,

Q68: Which of the following statements concerning estimated

Q87: Due to the alternative minimum tax rate

Q102: Cesare is 16 years old and works