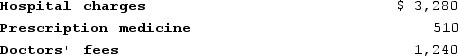

Erika (age 62)was hospitalized with injuries from an auto accident this year. She incurred the following expenses from the accident:

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Definitions:

Shared Sleeping

The practice of sleeping in close proximity to others, typically family members.

Breast Feeding

The act of feeding a baby with milk directly from the mother's breast, which provides essential nutrients and antibodies.

Brain Development

The process involving physical growth and maturation of the brain, including the formation of neurons, synaptic connections, and neural pathways.

Breathing Pauses

Temporary cessations of breathing, which can be normal or indicative of respiratory conditions.

Q6: Wilma has a $45,000 certificate of deposit

Q11: Murphy uses the accrual method and reports

Q20: The standard deduction amount varies by filing

Q31: The maximum amount of net capital losses

Q71: Cassy reports a gross tax liability of

Q105: For AGI deductions are commonly referred to

Q105: Joyce's employer loaned her $50,000 this year

Q110: The Inouyes filed jointly in 2020. Their

Q128: Doug and Lisa have determined that their

Q128: Gabby operates a pizza delivery service. This