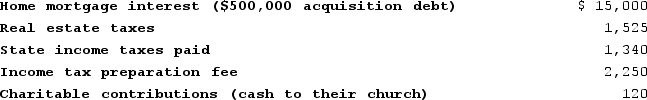

Misti purchased a residence this year. Misti, age 32, is a single parent and lives with her 1-year-old daughter. In 2020, Misti received a salary of $160,000 and made the following payments:

Misti files as a head of household. Calculate her taxable income this year.

Misti files as a head of household. Calculate her taxable income this year.

Definitions:

Smooth Muscle

Muscle tissue that forms organs like the stomach and bladder, characterized by its lack of striations and its ability to contract involuntarily.

Skeletal Muscle

A type of striated muscle tissue, attached to bones, that is responsible for voluntary movements of the body.

Cardiac Muscle

A specialized form of muscle found only in the heart, characterized by its ability to contract autonomously and rhythmically.

Skeletal Muscle Fibers

Long, cylindrical cells that make up skeletal muscles, responsible for voluntary movements.

Q3: Alain Mire files a single tax return

Q7: When determining whether a child meets the

Q25: Lebron received $50,000 of compensation from his

Q61: An investment's time horizon does not affect

Q65: Assume that Keisha's marginal tax rate is

Q77: This year, Fred and Wilma, married filing

Q83: Ms. Fresh bought 1,000 shares of Ibis

Q93: Henry, a single taxpayer with a marginal

Q107: Filing status determines all of the following

Q116: Bill operates a proprietorship using the cash