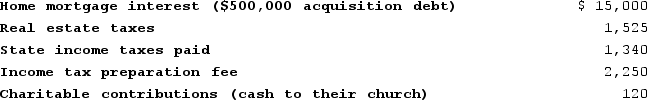

Misti purchased a residence this year. Misti, age 32, is a single parent and lives with her 1-year-old daughter. In 2020, Misti received a salary of $160,000 and made the following payments:

Misti files as a head of household. Calculate her taxable income this year.

Misti files as a head of household. Calculate her taxable income this year.

Definitions:

Albums

Collections of photographs, music, or digital content grouped together, typically by theme or artist.

Folders

Directories within a computer's file system used to organize and store files.

Five Categories

A generic term that could refer to the division of any set of items or subjects into five distinct groups.

Photos app

A software application designed for organizing, editing, and sharing photos stored on a computer or mobile device.

Q26: Wolfina's twins, Romulus and Remus, finished their

Q43: When applying credits against a taxpayer's gross

Q56: Joe is a self-employed electrician who operates

Q72: Deb has found it very difficult to

Q76: Generally, losses from rental activities are considered

Q106: Temporary regulations have more authoritative weight than

Q107: Filing status determines all of the following

Q112: Alton reported net income from his sole

Q114: George operates a business thatin 2020 generated

Q123: This fall Angelina, age 35, plans to