Multiple Choice

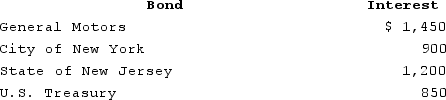

Mike received the following interest payments this year. What amount must Mike include in his gross income (for federal tax purposes) ?

Definitions:

Related Questions

Q1: Which of the following taxpayers (all age

Q4: The investment interest expense deduction is limited

Q65: Which of the following represents the largest

Q79: Rental income generated by a partnership is

Q89: Which of the following items is not

Q89: Passive losses that exceed passive income are

Q103: Last year Henry borrowed $10,000 to help

Q110: The effective tax rate expresses the taxpayer's

Q117: Tita, a married taxpayer filing jointly, has

Q138: Which of the following does not affect