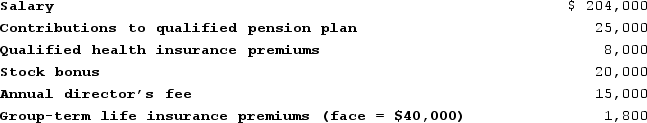

This year Joseph joined the board of directors for a company. Besides his director's fees, Joseph received the following employee benefits:

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation. At the time of the transfer the stock was listed at $4 per share. What amounts, if any, should Joseph include in gross income this year?

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation. At the time of the transfer the stock was listed at $4 per share. What amounts, if any, should Joseph include in gross income this year?

Definitions:

Skills

The abilities and expertise that individuals acquire through practice, training, or experience, which enable them to perform tasks effectively.

Strategic Planning Process

A structured and deliberate approach undertaken by organizations to define their strategy or direction and make decisions on allocating resources to pursue this strategy.

Human Resource Management

The strategic approach to managing people in an organization, focusing on policies and systems to maximize employee performance and well-being.

Strategic Vision

A statement about where the company is going and what it can become in the future; clarifies the long-term direction of the company and its strategic intent.

Q15: Leonardo, who is married but files separately,

Q38: Bob Brain files a single tax return

Q41: Claire donated 230 publicly traded shares of

Q64: Emily is a cash-basis taxpayer, and she

Q66: If tax rates are decreasing:<br>A)taxpayers should accelerate

Q72: In researching a question of fact, the

Q72: Judy, a single individual, reports the following

Q76: If no one qualifies as the dependent

Q77: An astute tax student once summarized that

Q95: Kaelyn's mother, Judy, looks after Kaelyn's four-year-old