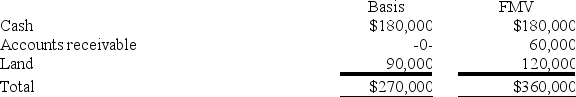

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Schachter and Singer

Psychologists known for their Two-Factor Theory of Emotion, proposing that emotion is based on physiological arousal and cognitive labeling of that arousal.

Two-factor Theory of Emotion

A psychological theory suggesting that an emotion is determined by a cognitive appraisal of a physiological arousal and the environmental context in which it occurs.

Arousing Injection

A hypothetical or experimental procedure aiming to increase physiological or emotional arousal through the administration of substances.

Confederate

A supposed participant in a research study who actually is working with the experimenters, unknown to the real participants.

Q5: What is the difference between the aggregate

Q9: A transfer of a terminable interest will

Q14: In general, an S corporation shareholder makes

Q18: Shauna is a 50% partner in the

Q21: Failure to collect and remit sales taxes

Q56: Loon, Inc. reported taxable income of $600,000

Q65: Alhambra Corporation, a U.S. corporation, receives a

Q70: A partner will recognize a loss from

Q74: The recipient of a tax-free stock distribution

Q97: Tatia's basis in her TRQ partnership interest