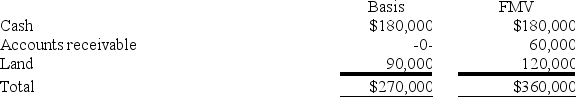

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Definitions:

Capital Gains

The profit realized from the sale of assets like stocks, bonds, or real estate when the sale price exceeds the purchase price.

Dividend Yield

The annual dividends a firm distributes, expressed as a ratio of its current stock price.

Taxable Income

The portion of an individual's or corporation's income used as the basis for calculating tax owed to the government, after all allowable deductions or exemptions.

Preferred Stock

Preferred stock is a class of shares that typically provides a fixed dividend and has priority over common stock in the event of a liquidation, but generally does not carry voting rights.

Q9: Nonrecourse debt is generally allocated according to

Q10: Congress reduced the corporate tax rate from

Q28: Which of the following statements best describes

Q29: Alexis transferred $400,000 to a trust with

Q35: Under which of the following circumstances will

Q40: Which of the following items would likely

Q65: This year Anthony transferred $250,000 of bonds

Q67: Which of the following is not a

Q83: Suppose SPA Corp. was formed by Sara

Q102: Sarah, Sue, and AS Inc. formed a