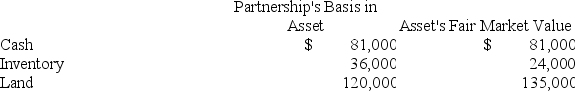

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Postsurgical Pain

Pain experienced after undergoing surgery, often a normal part of the healing process but sometimes indicating complications.

Nonsteroidal Antiinflammatory Drug

Medications that reduce inflammation, pain, and fever but are not corticosteroids.

Aggravating Factors

Circumstances or conditions that increase the severity or culpability of a criminal act or misconduct.

Pain Rating

A system used in healthcare to quantify or describe the intensity of an individual's pain experience, often on a numerical scale.

Q33: Which of the following statements does not

Q41: Mighty Manny, Incorporated manufactures and services deli

Q42: Clint noticed that the Schedule K-1 he

Q43: The applicable credit is designed to allow

Q47: Which of the following statements best describes

Q48: Which of the following is an income

Q55: Which of the following statements best describes

Q63: Sweetwater Corporation declared a stock distribution to

Q89: What form does a partnership use when

Q100: Separate return states require each member of