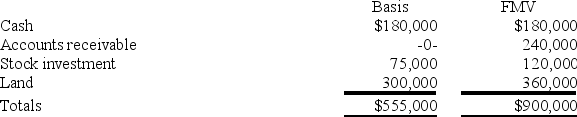

Katrina is a one-third partner in the KYR partnership (calendar year-end). Katrina decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1:

Katrina receives one-third of each of the partnership assets. She has a basis in her partnership interest of $250,000. What is the amount and character of any recognized gain or loss to Katrina? What is Katrina's basis in the distributed assets?

Definitions:

Demographic Information

Data related to the characteristics of populations, such as age, race, gender, income level, and education.

Related Fields

Areas of study or professional practice that share common knowledge, techniques, or research interests with another field.

Table

A structured arrangement of data made up of rows and columns, which can be used in documents or databases.

Record

An individual entry within a database that contains specific information across various fields pertaining to one entity.

Q2: Which of the following items are subject

Q24: Which of the following transactions engaged in

Q27: In December 2017, Zeb incurred a $100,000

Q35: If a taxpayer sells a passive activity

Q44: Which of the following does not adjust

Q63: Sweetwater Corporation declared a stock distribution to

Q64: Tim, a real estate investor, Ken, a

Q66: Which of the following is not a

Q70: A state's apportionment formula divides nonbusiness income

Q85: Gordon operates the Tennis Pro Shop in