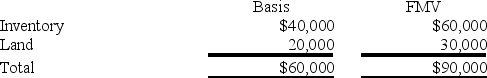

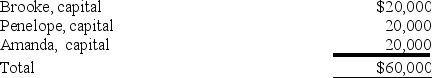

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Taste Aversion

A learned aversion or negative reaction to a particular taste after a bad experience, such as illness, associated with that flavor.

Taste Aversion

A learned aversion to eating a particular food, developed after it has been associated with an unpleasant reaction.

Garcia and Koelling

Researchers known for their studies on taste aversion, demonstrating that animals associate certain tastes with sickness, leading to aversion of those tastes.

Conditioning Principles

Fundamental concepts in behaviorism that describe how responses to certain stimuli are learned through reinforcement or punishment.

Q21: Don and Marie formed Paper Lilies Corporation

Q35: Clampett, Inc. has been an S corporation

Q43: Entities classify all deferred tax assets and

Q43: Simon transferred 100 percent of his stock

Q43: Explain why partners must increase their tax

Q72: Which of the following statements is True?<br>A)

Q76: The Emerging Issues Task Force assists the

Q80: In X1, Adam and Jason formed ABC,

Q86: Abbot Corporation reported a net operating loss

Q113: Giving samples and promotional materials without charge