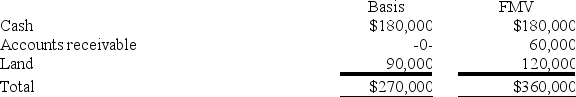

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Smartest Business Decision

A highly intelligent or wise choice made in the context of business operations, usually leading to significant positive outcomes.

Full Refund

The total amount of money returned to a customer for a product or service that did not meet the expected standards or satisfaction.

Reduced Rate

A discounted price offered from the regular cost of goods or services.

Motivate Action

The process of inspiring or encouraging individuals or groups to take desired actions or engage in specific behaviors.

Q3: Cardinal Corporation reported pretax book income of

Q8: Bismarck Corporation has a precredit U.S. tax

Q18: Shauna is a 50% partner in the

Q24: Why are guaranteed payments deducted in calculating

Q33: Suppose at the beginning of 2018, Jamaal's

Q52: On January 1, 2017, GrowCo issued 50,000

Q54: The tax effects of permanent differences generally

Q75: The primary purpose of state and local

Q77: A taxpayer must receive voting common stock

Q82: Which of the following is not an