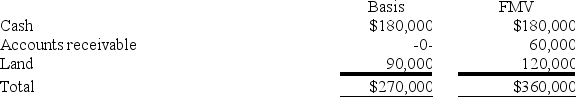

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Definitions:

Dissociative Identity Disorder

A severe form of dissociation, a mental process which produces a lack of connection in a person's thoughts, memory, and sense of identity, formerly known as multiple personality disorder.

Severe Schizophrenia

A more intense form of schizophrenia characterized by strong symptoms such as profound disorganization of thought and behavior or severe hallucinations and delusions.

Neuroimaging

The use of various techniques to either directly or indirectly image the structure, function, or pharmacology of the nervous system.

Temporal Lobes

The regions of the cerebral cortex behind the temples, important for interpreting sounds and language, and for encoding memories.

Q16: The built-in gains tax does not apply

Q18: Harry and Sally formed Empire Corporation on

Q34: The annual value of rented property is

Q46: Which of the following is a requirement

Q48: The estate and gift taxes share several

Q73: Wyoming imposes an income tax on corporations.

Q80: During 2018, CDE Corporation (an S corporation

Q84: Partners adjust their outside basis by adding

Q91: Big Company and Little Company are both

Q118: Built-in gains recognized fifteen years after a