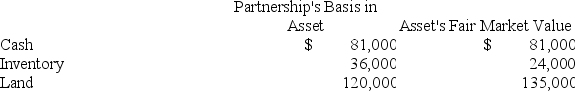

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Residual Income

Income that continues to be generated after the initial effort has been expended, or in managerial accounting, the operating income that an investment center earns above the minimum required return on its operating assets.

Minimum Required Rate

The lowest return on investment that an investor is willing to accept, considering the risk involved.

Residual Income

The net operating income an investment earns above the minimum rate of return expected by its investors or company management.

Turnover

The rate at which inventory is sold and replaced or an employee leaves and is replaced within a company.

Q3: Terrapin Corporation incurs federal income taxes of

Q18: General Inertia Corporation made a pro rata

Q48: If a partner participates in partnership activities

Q63: Which of the following is True regarding

Q68: April transferred 100 percent of her stock

Q81: Antoine transfers property with a tax basis

Q85: Gordon operates the Tennis Pro Shop in

Q87: Including adjusted taxable gifts in the taxable

Q90: Which of the following statements regarding disproportionate

Q109: Hazel is the sole shareholder of Maple