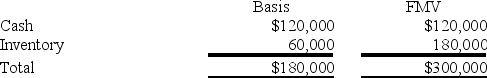

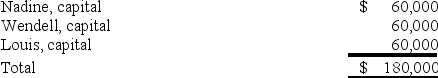

Nadine Fimple is a one-third partner in the NWL Partnership with equal inside and outside bases. On January 1, NWL distributes $100,000 to Nadine in complete liquidation of her FPL interest. NWL's balance sheet as of January 1 is as follows:

What is the amount and character of Nadine's recognized gain or loss on the distribution?

Definitions:

Free Nerve Endings

Sensory nerve fibers that terminate loosely in the tissue and are involved in sensing pain, temperature, and touch.

Mechanoreceptors

Sensory receptors that respond to mechanical pressure or distortion, playing key roles in touch and sound perception.

Compression

The act of pressing together to reduce size or volume, often used in medical treatments or data reduction techniques.

Taste Buds

Sensory organs located on the tongue's surface that contain the taste receptor cells, which detect different flavors.

Q12: The gross estate includes the value of

Q15: Gary and Laura decided to liquidate their

Q20: If partnership debt is reduced and a

Q62: Which of the following statements best describes

Q70: A partner will recognize a loss from

Q79: Which of the following items is not

Q91: Does adjusting a partner's basis for tax-exempt

Q96: Red Blossom Corporation transferred its 40 percent

Q119: Clampett, Inc. has been an S corporation

Q123: Proceeds of life insurance paid due to