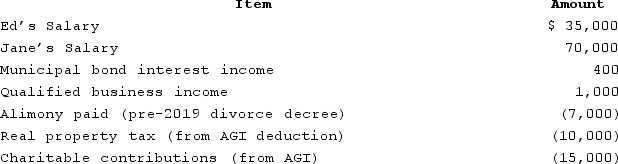

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's gross income?

Definitions:

Schedule C

Schedule C is a tax form used by sole proprietors to report business income and expenses for tax purposes.

Schedule K-1

Schedule K-1 is a tax document used to report the income, deductions, and credits of a partnership or S corporation to its partners or shareholders.

Form 1099-MISC

A tax form used to report miscellaneous income, including fees, royalties, commissions, and rental income, to the IRS.

Oil Wells

These are drilling operations established to explore and extract petroleum and natural gas from underground reserves.

Q11: To calculate a tax, you need to

Q18: Generally, if April 15 <sup>th</sup> falls on

Q30: Kodak is a beginning tax researcher. He

Q63: Amanda purchased a home for $820,000 in

Q72: Virtually every transaction involves the taxpayer and

Q90: Which of the following is NOT a

Q94: In certain circumstances, a taxpayer who does

Q103: Miguel, a widower whose wife died in

Q115: Which of the following is not required

Q119: For purposes ofdetermining filing status, which of