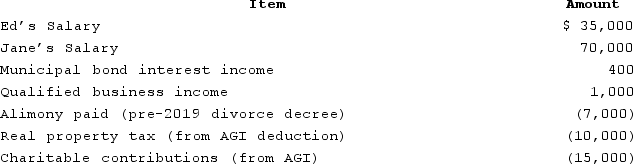

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

Definitions:

Self-Monitoring

An individual difference in people’s desire and ability to adjust their self-presentations for different audiences.

Psychological Reactance Theory

A theory which proposes that people value thinking and acting freely. Therefore, situations that threaten their freedom arouse discomfort and prompt efforts to restore freedom.

Regulatory Focus Theory

The theory proposing that individuals regulate their behavior via two distinct systems: promotion focus (pursuit of goals and aspirations) and prevention focus (avoidance of negative outcomes).

Elaboration Likelihood Model

A theory in social psychology that explains the different ways people process persuasive messages, either through careful thought and evaluation or more automatic responses.

Q12: Toshiomi works as a sales representative and

Q24: Inventory is a capital asset.

Q38: Which of the following types of tax

Q42: Houston has found conflicting authorities that address

Q44: Brandon and Jane Forte file a joint

Q52: Taxpayers may make an election to include

Q61: Marc, a single taxpayer, earns $64,600 in

Q66: If tax rates are decreasing:<br>A)taxpayers should accelerate

Q105: When a taxpayer experiences a net loss

Q112: Margaret Lindley paid $15,060 of interest on