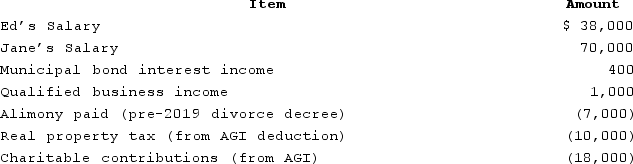

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

Definitions:

Standard Deviation

A statistic that measures the dispersion of a dataset relative to its mean, indicating how spread out the data points are.

Unbiased Estimates

Refers to statistical estimates that are expected to be equal to the true values of the parameter being estimated, showing no systematic error.

Population Estimates

Calculations that infer the number of individuals in a population at a certain time.

Variability

How much the data points in a statistical distribution or dataset deviate from the mean or average.

Q19: In addition to raising revenues, specific U.S.

Q31: The maximum amount of net capital losses

Q53: A common income-shifting strategy is to:<br>A)shift income

Q56: In certain circumstances, a married taxpayer who

Q60: Chris and Chuck were recently debating whether

Q65: How are individual taxpayers' investment expenses and

Q99: The character of income is a factor

Q108: Which of the following statements regarding exclusions

Q114: Which of the following statements regarding limitations

Q125: Assume that Javier is indifferent between investing