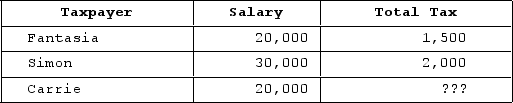

Given the following tax structure, what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure?

Definitions:

Significance Level

A threshold below which a p-value is considered statistically significant, indicating that observed results are unlikely to be due to chance.

Critical Value

The point or points on the scale of a test statistic beyond which we reject the null hypothesis; these values define the threshold of significance.

Test Statistic

A value, derived from sample data, used in a hypothesis test to determine whether to reject the null hypothesis.

P-value

The probability of observing data at least as extreme as the observed data, given that the null hypothesis is true.

Q10: In 2020, Madison is a single taxpayer

Q13: Generally, the amount realized is everything of

Q14: Taxpayers are allowed to claim a child

Q15: The IRS DIF system checks each tax

Q29: When an employer matches an employee's contribution

Q54: Assume that Javier is indifferent between investing

Q60: Taxpayers meeting certain requirements may be allowed

Q68: A sales tax is a common example

Q105: When a taxpayer experiences a net loss

Q113: The relationship test for qualifying relative requires