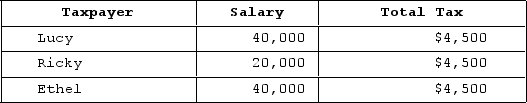

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Manufacturing Overhead

All indirect costs associated with the manufacturing process, excluding direct materials and direct labor.

Activity-Based Costing

An approach to costing that recognizes activities within an organization and distributes their costs across all products and services according to the real consumption of each.

Product Margin

The difference between the selling price of a product and its production costs, indicating the profitability of a product.

Activity-Based Costing

A method of allocating costs to products and services based on the activities that contribute to those costs instead of on traditional measures like machine hours.

Q2: The time value of money suggests that

Q30: Jayzee is a single taxpayer who operates

Q34: Suzanne received 20 ISOs (each option gives

Q43: Jane is an employee of Rohrs Golf

Q48: Caitlin is a tax manager for an

Q49: Ryan, age 48, received an $8,000 distribution

Q50: Leonardo, who is married but files separately,

Q55: If an unmarried taxpayer iseligible to claim

Q88: Which of the following sections does not

Q96: Which of the following statements regarding deductions