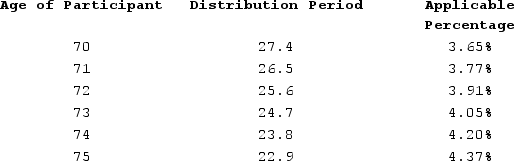

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account (not a coronavirus-related distribution). Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Definitions:

Sexual Desire

The feeling of wanting or craving sexual activities, which can vary in intensity across different individuals and contexts.

Chronic Illness

A long-term health condition that requires ongoing management and may not have a cure, often affecting an individual's lifestyle and well-being.

Reminiscence Therapy

A therapy that encourages individuals, often older adults, to recall and share memories as a part of psychological healing or comfort.

Chronic Illness

A long-lasting condition that can be controlled but not cured, often requiring ongoing medical attention and affecting daily living.

Q9: Dean has earned $70,000 annually for the

Q22: Boot is not like-kind property involved in

Q28: Which of the following depreciation conventions is

Q30: A parcel of land is always a

Q33: Gessner LLC patented a process it developed

Q47: Luke sold land valued at $210,000. His

Q49: A taxpayer can avoid an underpayment penalty

Q50: Why have newspaper revenues declined over the

Q61: Jennifer owns a home that she rents

Q83: Which of the following statements best describes