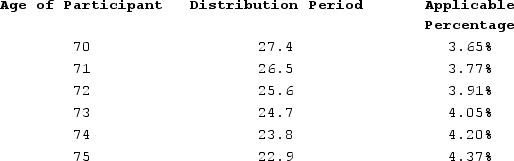

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,800,000. Using the Treasury tables below, what is Sean's required minimum distribution for 2020?

Definitions:

Alternative Minimum Tax

A parallel tax system to the regular income tax that ensures that certain taxpayers pay at least a minimum amount of tax.

Corporations

Legal entities that are separate from their owners, capable of owning property, entering contracts, and being taxed.

Subject

A broad term typically referring to the main topic or person being discussed or studied.

Schedule M-1

A form used by corporations in the U.S. to reconcile income reported for tax purposes with income reported for financial reporting purposes.

Q15: In 2017, the various entertainment industries together

Q18: Curtis invests $450,000 in a city of

Q23: Taxpayers who participate in an employer-sponsored retirement

Q51: Which of the following audits is the

Q66: Campbell was researching a tax issue and

Q80: Taylor LLC purchased an automobile for $55,000

Q85: Junior earns $80,000 taxable income as a

Q106: Which of the following statements concerning individual

Q121: In a deferred like-kind exchange, the like-kind

Q125: Real property is depreciated using the straight-line