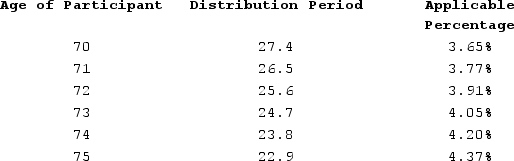

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,800,000. Using the Treasury tables below, what is Sean's required minimum distribution for 2020?

Definitions:

Direct Labor Hours

The total hours worked by employees directly involved in the production process, used in costing and pricing decisions.

Q5: Jorge owns a home that he rents

Q5: Hotel employees can receive free lodging on

Q7: Lavonda discovered that the 5 <sup>th</sup> Circuit

Q14: For determining whether a taxpayer qualifies to

Q27: All taxpayers may use the §179 immediate

Q66: Dynamic forecasting does not take into consideration

Q83: A common example of an employment-related tax

Q105: An asset's tax-adjusted basis is usually greater

Q108: An asset's capitalized cost basis includes only

Q123: Anne LLC purchased computer equipment (five-year property)on