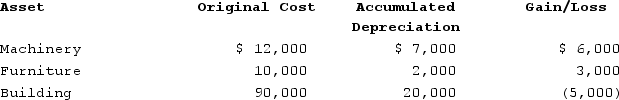

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Immigrants

People who move to a foreign country or region with the intention of settling and living there, often in search of better life opportunities, work, or safety.

Blacks

Refers to individuals of African descent, often used within the context of discussing historical and contemporary issues of race and culture.

Executive Order 8802

A landmark order issued by President Franklin D. Roosevelt in 1941, prohibiting ethnic or racial discrimination in the defense industry or government.

Rhetoric

The art of effective or persuasive speaking or writing, especially the use of figures of speech and other compositional techniques.

Q22: Define privacy, information privacy, the right to

Q24: Wheeler LLC purchased two assets during the

Q41: Expenses of a vacation home allocated to

Q46: _ convergence describes the development of hybrid

Q52: On December 1, 2020, Irene turned 73

Q68: Which of the following is not an

Q72: A taxpayer can only receive a saver's

Q72: Suzanne received 50 ISOs (each option gives

Q74: Arlington LLC exchanged land used in its

Q99: The basis for a personal-use asset converted