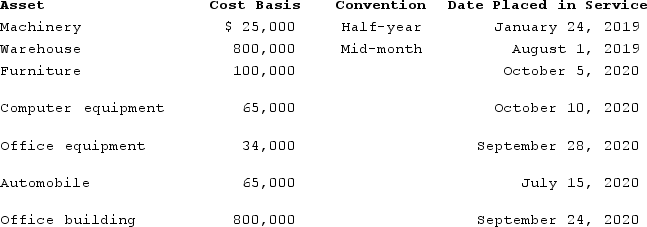

BoxerLLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2019 and 2020:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.)(Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.)(Round final answer to the nearest whole number.)

Definitions:

Synergies

The combined benefits achieved when two or more entities work together, leading to greater efficiency or productivity than they would separately.

Acquisition

The process of acquiring control of another company or business entity through purchase or merger.

Profitable

Generating income that exceeds the costs and expenses involved in operating, indicating financial success and viability.

Vertical Contracts

Agreements between firms at different levels in the supply chain, such as between a manufacturer and a retailer, often specifying terms of sale or supply.

Q15: Ads that appear in a Facebook user's

Q21: Jorge purchased a copyright for use in

Q24: Typically, the more security measures added to

Q24: Which of the following is most similar

Q25: Odintz traded land for land. Odintz originally

Q40: Which of the following statements about BLE

Q45: Which of the following did the Internet

Q61: Which of the following is not a

Q90: Which of the following statements concerning traditional

Q114: Tax depreciation is currently calculated under what