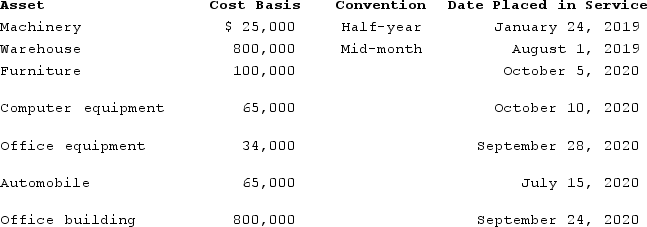

BoxerLLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2019 and 2020:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.)(Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.)(Round final answer to the nearest whole number.)

Definitions:

NEO Personality Inventory

A psychological assessment tool that measures the Big Five personality traits: neuroticism, extraversion, openness, agreeableness, and conscientiousness.

Personality Assessment

The assessment and analysis of psychological characteristics, actions, and outlooks to comprehend a person's character.

Inner Reality

The subjective experience or personal world of an individual, including thoughts, feelings, and perceptions that are not immediately observable by others.

Private Self

The aspect of a person's self-concept that includes thoughts, feelings, and desires not expressed or visible to others.

Q12: In the wholesale model of e-book distribution,

Q17: A deferred like-kind exchange does not help

Q43: How do the Interactive Advertising Bureau's new

Q49: Which of the following is not usually

Q62: Which of the following search engine algorithm

Q66: Which of the following is the most

Q68: The incremental cost of building the next

Q84: Potomac LLC purchased an automobile for $31,800

Q118: Which of the following statements regarding restricted

Q134: Kathy is 60 years of age and